Income Tax Return Filling is a lot easier and more convenient now than ever even when you do not consider the private or third-party websites and applications for the ITR. The official ITD website has evolved and is alone enough for the ITR filings. However, some issues in the ITR process still need to be improved to make it more efficient.

Recently some users have encountered issues with receiving your income tax refund or the refund was not credited to their bank account. This can be resolved by raising the refund reissue request but it simply took almost a week or more to acknowledge the issue by the Income Tax Department and allow users to raise the refund reissue request.

The most common error received by the users in ITR intimation was the “Account not linked with the PAN” This error occurred even when the user had already linked the bank account with the PAN. But, this was mostly for the users who added and validated their bank account for refund long back, maybe a couple of years.

So one of the learnings and quick fixes to avoid the ITR credit failure is to re-validate the account before starting the ITR filing process. The user should try to submit the ITR filling only after successfully re-validating the bank accounts set or nominated for the refund.

There have been a large number of complaints that the user is not getting the option to raise the refund reissue request, in that case, users may need to Submit a Refund Reissue Grievance on the ITD Website. This usually takes a minimum of 48 hours to resolve or address the Grievance by ITD support team, once the ticket is addressed ITD will send an email regarding the update.

This applies to most refund failure cases, so in case you get intimation about the refund failure, this process ensures that you get your rightful refund directly into your bank account. In this follow-up guide, we’ll walk you through how to submit a refund reissue request step by step.

1. Log into the Income Tax e-Filing Portal

- Visit the official Income Tax Department website.

- Click on the Login button at the top right corner of the homepage.

- Enter your User ID (your PAN number) and password to log in.

If you don’t have an account yet, you will need to register first by clicking on the Register button and following the instructions.

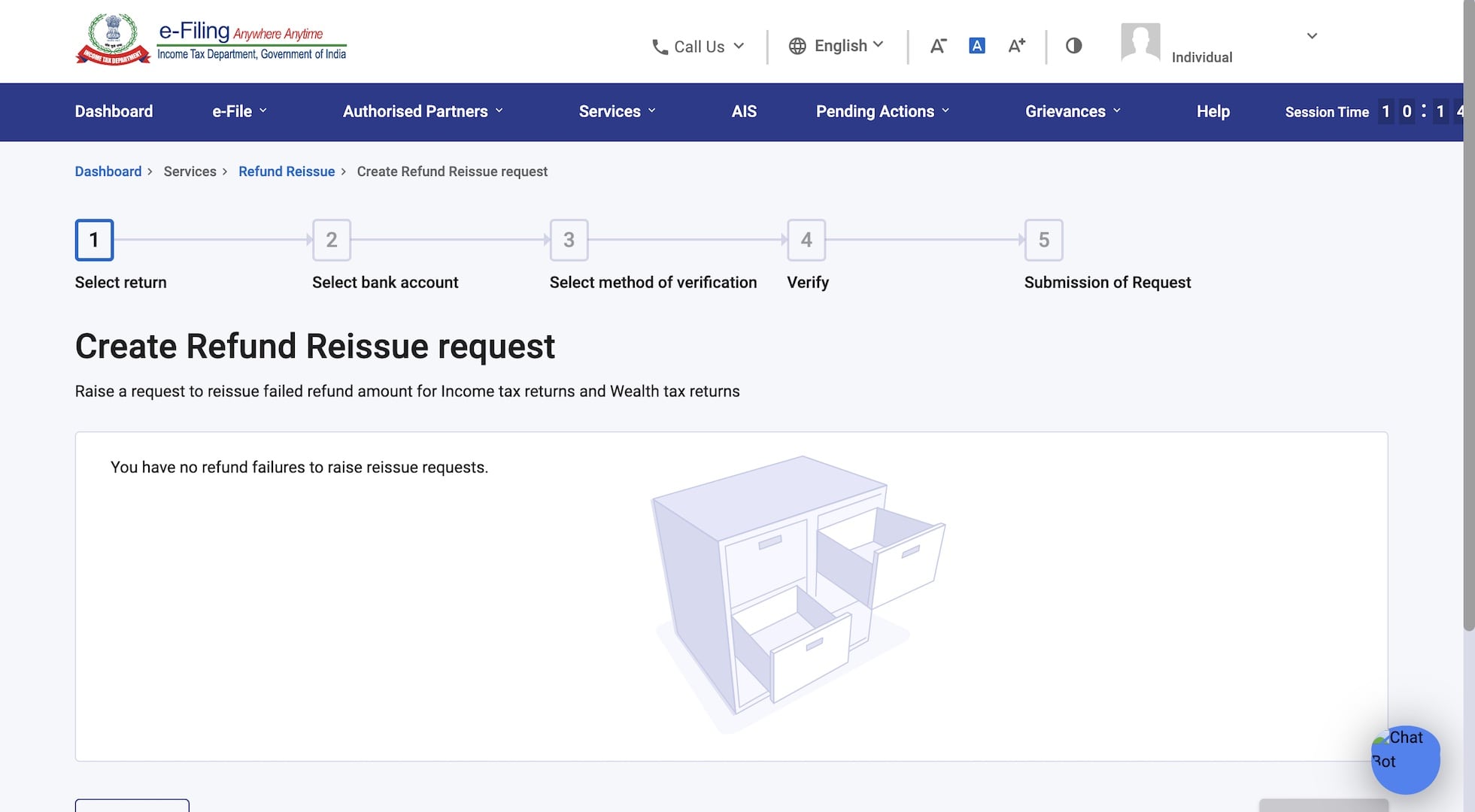

2. Navigate to the Refund Reissue Option:

- After login to your account on the ITD website.

- On the dashboard, find and click on the Services option from the main menu.

- Under the services section, click on Refund Reissue.

3. Submit Your Refund Reissue Request:

- You will be presented with the option to view all the refunds that have failed or are pending reissue.

- Select the refund you want to reissue and click on Submit Refund Reissue Request.

4. Provide or Update Bank Account Details:

- If your refund failed due to incorrect bank account details or PAN not linked or you just want to change or update the bank account to receive the refund you can do that at this stage.

- Choose the correct bank account where you wish to receive the refund. Make sure the bank account is pre-validated in the e-filing portal.

- Submit the refund reissue request by validating with the OTP.

- Once you successfully submit the request, you will get a notification from ITD via email or SMS.

How To Re-Validate a Bank Account for ITR?

- Go to Profile Settings and click on My Bank Account.

- Choose your bank account and click on Re-Validate.

- You will receive the OTP on your registered phone and email.

- Enter the OTP to complete the Re-Validate process.

- If your bank account is not coming up there or not letting you “Re-Validate” then you can try to remove/delete and add the bank account details freshly from the same screen. Just ensure that your bank account is linked with your PAN and UID.

5. Track Your Refund Reissue Request:

- To keep track of your refund reissue request:

Log in again and go to My Account > Refund/Demand Status. - Here, you can see the status of your refund reissue request and track its progress.

In case of any issues you may raise the support ticket or grievance on the ITD website, you may also reach out to the ITD via live chat or call the toll-free number. They usually respond and resolve the issues speedily.